AIFMD Risk Management & Regulatory Reporting

The ES Risk Management and Regulatory Reporting team consists of highly experienced, technical and service-driven professionals, who utilise proprietary, industry-leading technology to provide a seamless risk management and regulatory reporting solution for European Fund Management. Transparent, concise and in-depth support is a standard feature of the ES service.

- Risk performed without investment manager input for verifiable independence

- Enhanced risk in the areas of scenario testing, back-testing, what-if analysis, liquidity matching and monitoring in addition to the standard requirement of VAR, sector analysis etc

- Assessment of the fund’s compliance with hard and soft investment restrictions

As part of a comprehensive suite of regulatory compliance solutions, ES generates regulatory filings in the required format for each local financial regulator. After receiving portfolio data from the Fund Administrator, Investment Manager or other suitable party, ES will process, map and enrich the data with feeds from leading market vendors, to deliver a complete end-to-end solution. As such, Investment Managers will receive a signature-ready filing without the burden of compiling, calculating and completing the report.

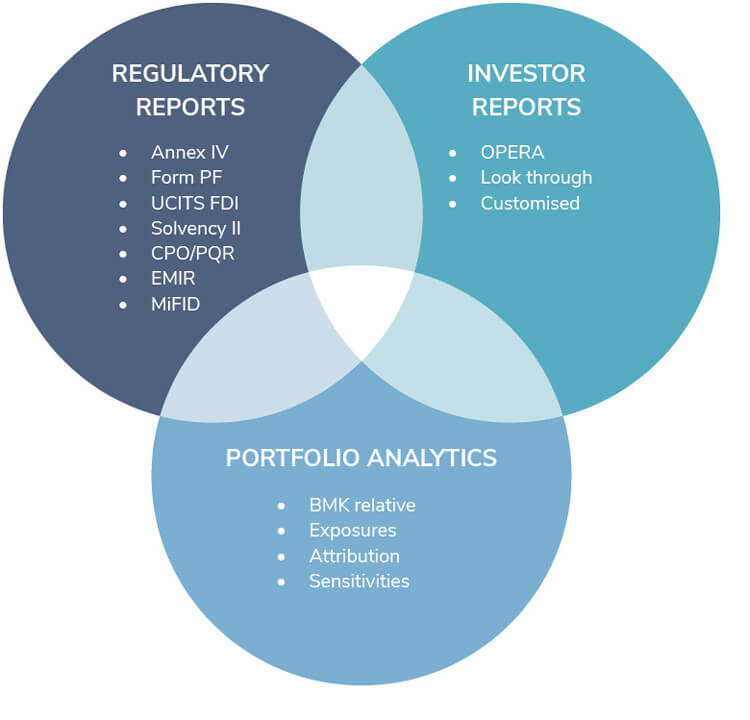

Regulatory Reports

- Annex IV

- Form PF

- UCITS FDI

- Solvency II

- CPO/PQR

- EMIR

- MiFID

Investor Reports

- OPERA

- Look through

- Customized

Portfolio Analytics

- BMK relative

- Exposures

- Attribution

- Sensitivities